When considering investments in the Indian stock market, Bajaj Finance share price NSE stands out as one of the most popular and high-performing stocks. As a leading player in the non-banking financial sector, Bajaj Finance Ltd. has built a strong reputation for delivering steady growth and consistent performance. Tracking Bajaj Finance share price NSE is essential for investors looking to make informed decisions about buying, selling, or holding their shares in this top-performing financial company.

Table Of Contents

- What Is Bajaj Finance Share Price NSE?

- Overview of Bajaj Finance Ltd.

- Factors Affecting Bajaj Finance Share Price NSE

- Historical Performance of Bajaj Finance Share Price NSE

- Why Should You Track Bajaj Finance Share Price NSE?

- How to Track Bajaj Finance Share Price NSE

- Bajaj Finance Share Price NSE: Key Milestones

- Risks in Investing in Bajaj Finance Share Price’s NSE

- Future Outlook for Bajaj Finance Share Price’s NSE

- Conclusion

What Is Bajaj Finance Share Price NSE?

This article explores the intricacies of Bajaj Finance share prices NSE, its historical trends, factors that influence the share price, and why it is crucial for potential investors to keep an eye on it. Whether you are new to investing or an experienced trader, this guide provides valuable insights into the movement and performance of Bajaj Finance share price NSE.

Overview of Bajaj Finance Ltd.

Bajaj Finance Ltd., part of the Bajaj Finserv Group, is one of India’s leading non-banking financial companies (NBFCs). Established in 1987, Bajaj Finance has expanded its offerings to include consumer loans, business loans, wealth management, insurance products, and more. Over the years, Bajaj Finance has positioned itself as a market leader in the financial services industry, gaining investor confidence due to its strong business model and innovative approach.

The company is listed on the National Stock Exchange of India (NSE), where the Bajaj Finance share prices NSE is tracked by traders and investors alike. The company’s performance directly impacts the Bajaj Finance share prices NSE, making it a crucial stock for market watchers and potential investors.

Factors Affecting Bajaj Finance Share Price NSE

The price of Bajaj Finance share prices NSE is influenced by various factors, both internal and external. Some of the key elements include:

Market Trends and Economic Factors

Broad market trends and the overall economic environment play a significant role in determining Bajaj Finance share prices NSE. If the stock market is experiencing a bull run, Bajaj Finance share prices NSE is likely to benefit from the positive sentiment. Conversely, during market downturns, the share price may face downward pressure. Additionally, economic factors like inflation rates, interest rates, and GDP growth also impact the stock’s performance.

Company Performance

The financial performance of Bajaj Finance Ltd. is one of the biggest factors affecting its share price. Investors look at quarterly and annual reports to gauge the company’s profitability, revenue growth, asset quality, and loan book performance. Strong financial results generally lead to an increase in Bajaj Finance share prices NSE, while poor earnings or a decline in revenue can result in a decrease.

Regulatory Influence

As a financial services company, Bajaj Finance is subject to regulations set by government bodies such as the Reserve Bank of India (RBI). Changes in policies or new regulations can impact the company’s operations and profitability, thus influencing Bajaj Finance share prices NSE. Regulatory changes affecting interest rates, capital adequacy norms, or loan provisioning can all cause fluctuations in the share price.

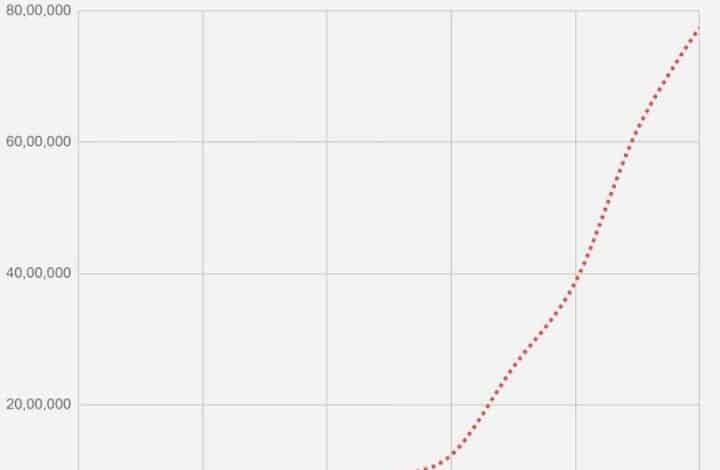

Historical Performance of Bajaj Finance Share Price NSE

To understand the potential of Bajaj Finance share prices NSE, it’s essential to analyze its historical performance. Over the past decade, the stock has demonstrated impressive growth. Below is a table that shows the Bajaj Finance share prices NSE performance over recent years:

| Year | Share Price (Start of Year) | Share Price (End of Year) | Annual Growth (%) |

| 2019 | ₹3,300 | ₹4,000 | 21.21% |

| 2020 | ₹4,000 | ₹6,200 | 55.00% |

| 2021 | ₹6,200 | ₹7,500 | 20.97% |

| 2022 | ₹7,500 | ₹8,500 | 13.33% |

| 2023 (YTD) | ₹8,500 | ₹10,000 | 17.65% |

As shown in the table above, Bajaj Finance share prices NSE has seen impressive growth, making it one of the best-performing stocks in its sector. The share price increase indicates that Bajaj Finance Ltd. has consistently delivered strong financial results, maintaining investor confidence.

Why Should You Track Bajaj Finance Share Price NSE?

Tracking Bajaj Finance share prices NSE is important for investors who want to stay informed about the stock’s performance. Here are several reasons why you should closely monitor Bajaj Finance share prices NSE:

Investment Insights

By regularly tracking Bajaj Finance share prices NSE, investors can gain insights into market sentiment and investor confidence in the company. Monitoring price fluctuations can help investors make informed decisions about buying or selling shares, maximizing profits, and minimizing losses.

Risk Assessment

Investors can assess the level of risk associated with Bajaj Finance share prices NSE by looking at its price volatility. If the stock price is fluctuating widely, it may indicate higher risk, while a stable price might suggest a more predictable investment. By tracking the price movements, investors can determine the right time to enter or exit their positions in the stock.

Future Growth Potential

Understanding the historical growth patterns and trends of Bajaj Finance share prices NSE provides valuable insights into the company’s future potential. If the company continues to perform well and expand its business, it is likely that Bajaj Finance share prices NSE will continue to rise, offering long-term growth opportunities for investors.

How to Track Bajaj Finance Share Price NSE

Tracking Bajaj Finance share prices NSE is easy, thanks to the availability of multiple platforms that provide real-time updates. Some of the most common ways to track the stock’s performance include:

- Stock Market Websites: Websites like Moneycontrol, NSE India, and Yahoo Finance offer real-time data on Bajaj Finance share prices NSE. These platforms provide detailed charts, news updates, and performance analysis.

- Stockbroker Platforms: If you have a trading account with a stockbroker, you can track Bajaj Finance share prices NSE directly through their platform. Most brokers offer advanced tools to track live stock prices and receive notifications about price movements.

- Mobile Apps: Many stock market apps are available for smartphones, offering live updates on Bajaj Finance share prices NSE. Apps like Zerodha, Groww, and Upstox make it easy to monitor prices on the go.

Bajaj Finance Share Price NSE: Key Milestones

Over the years, Bajaj Finance share prices NSE has hit several key milestones. Some of the notable events include:

- 2019-2020 Growth Surge: The stock price saw a massive surge from ₹4,000 at the beginning of 2020 to ₹6,200 by the end of the year, fueled by strong financial results and a recovery in the market.

- Continued Growth in 2021 and 2022: The upward trend continued in 2021 and 2022, as Bajaj Finance maintained its leadership position in the financial services industry and continued to expand its product portfolio.

- Recent Performance in 2023: The Bajaj Finance share prices NSE reached ₹10,000 in 2023, reflecting the company’s continued growth and the increasing demand for financial services.

Risks in Investing in Bajaj Finance Share Price’s NSE

While Bajaj Finance share prices NSE offers considerable growth potential, investors should also be aware of the risks involved:

- Economic Downturns: As an NBFC, Bajaj Finance’s performance is linked to the overall economy. Economic slowdowns or a recession can affect the company’s loan book and financial stability, leading to a drop in share prices.

- Rising Interest Rates: Higher interest rates can impact Bajaj Finance’s ability to lend at competitive rates, which could affect its profitability and subsequently impact Bajaj Finance share prices NSE.

- Regulatory Changes: Changes in financial regulations or government policies could affect the company’s operations, influencing the stock price.

Future Outlook for Bajaj Finance Share Price’s NSE

The future of Bajaj Finance share prices NSE looks promising, driven by several factors:

- Expanding Market: As India’s middle class continues to grow, demand for financial products such as loans, insurance, and wealth management will increase. This will benefit Bajaj Finance, further boosting its market position and share price.

- Technological Advancements: Bajaj Finance continues to invest in technology to enhance its services, improve customer experience, and streamline its operations. This focus on innovation is expected to drive further growth, positively impacting the stock price.

- Strong Management and Strategy: Bajaj Finance’s management team has a proven track record of executing effective strategies that drive growth. As the company continues to expand and diversify, Bajaj Finance share prices NSE is likely to see steady growth.

Conclusion

Bajaj Finance share prices NSE is an important stock to watch for investors interested in the financial services sector. The company’s strong performance, diversified business model, and consistent growth have made it a top choice for both short-term traders and long-term investors. By tracking Bajaj Finance share prices NSE, investors can gain valuable insights into the market and make informed decisions about their investments.

With a promising future and a robust business model, Bajaj Finance share prices NSE is poised for continued growth, making it a strong addition to any investment portfolio. However, as with any investment, it’s important to stay informed, track the stock regularly, and understand the risks involved.